Are You In Need Of A Monetary Advisor? Discover Vital Queries To Make For A Protected Investment Course

Uploaded By-McDowell Kloster

Prior to entrusting your financial resources to an economic advisor, ensure you have a clear understanding of their history, certifications, and regulatory standing. Understanding how they approach investments, their methods, and decision-making process is essential to straightening your objectives with their techniques. Additionally, probing right into their charge structure and possible conflicts of rate of interest can stop shocks down the road. By resolving these basic inquiries, you pave the way for a more educated and equally beneficial economic collaboration.

Recognizing Financial Advisor Credentials

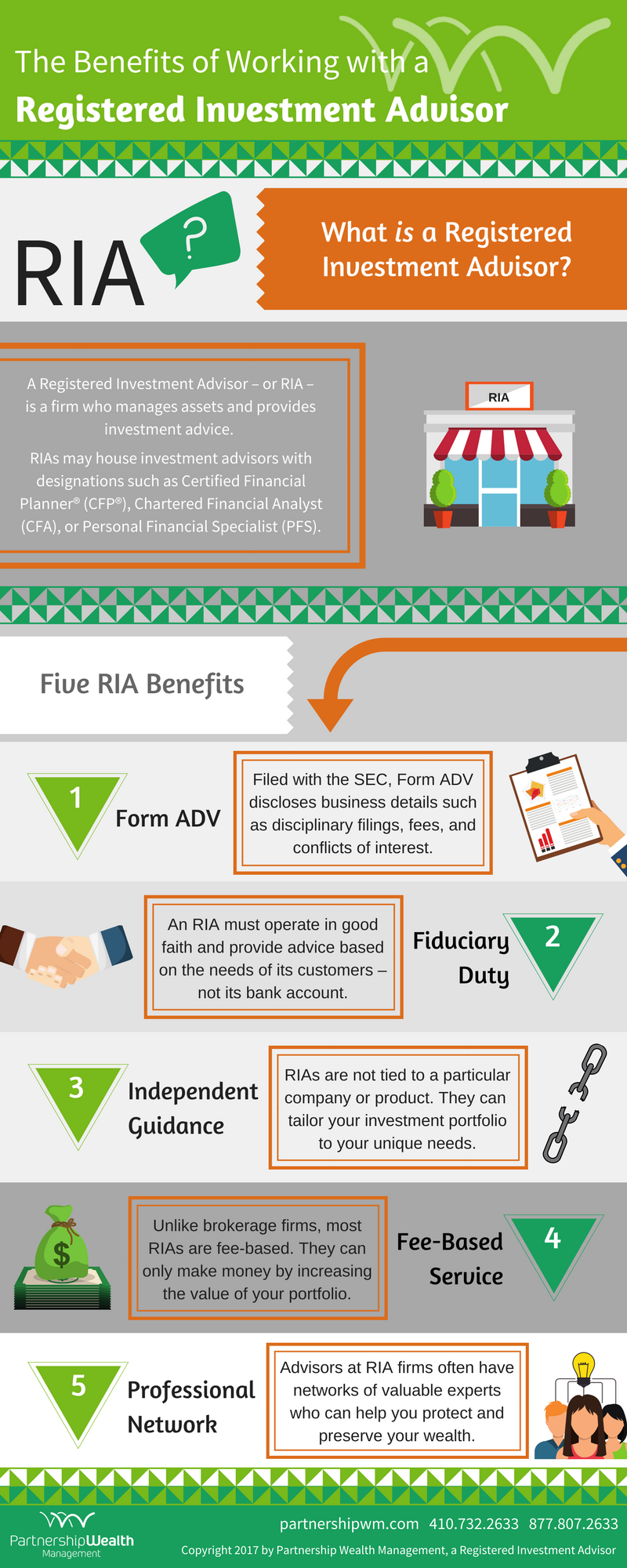

Prior to selecting a financial consultant, guarantee you understand their qualifications and qualifications. It's critical to examine their history to ensure they have actually the essential proficiency to handle your financial investments properly. Look for experts that hold credible qualifications such as Certified Monetary Coordinator (CFP), Chartered Financial Expert (CFA), or Chartered Financial Expert (ChFC). These designations suggest that the advisor has actually undertaken extensive training and satisfied specific standards of competence in the monetary industry. In addition, check if the consultant is signed up with the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). Enrollment with these governing bodies ensures that the advisor adheres to stringent moral and professional requirements.

In addition, consider the consultant's experience in the market. A seasoned consultant with a proven performance history might provide even more extensive insights and techniques to help you attain your monetary goals. Do not think twice to inquire about their previous performance and customer success stories. By thoroughly evaluating a monetary advisor's credentials, you can make an educated decision and choose somebody who's qualified to guide you via your investment journey.

Clarifying Investment Approaches

To guarantee your investments line up with your financial goals, it is very important to make clear the certain strategies your financial advisor plans to carry out. Recognizing the financial investment techniques your expert plans to make use of can aid you analyze whether they suit your risk resistance, timeline, and purposes.

Begin by asking about the overall technique - whether it's passive, energetic, or a combination of both. Passive approaches usually entail tracking a market index, while energetic techniques include even more regular buying and selling to exceed the marketplace.

Additionally, inquire about the asset appropriation strategy. https://writeablog.net/zack2clarice/wealth-monitoring-for-millennials-tips-for-building-long-term-financial includes exactly how your cash will certainly be dispersed throughout different possession courses like supplies, bonds, and realty. Recognizing this breakdown can offer you understanding into the level of diversification in your profile.

Don't forget to go over the financial investment option process. Ask how details financial investments are selected and whether they line up with your worths and lasting economic goals. By understanding these approaches, you can make educated decisions about your investments and work towards attaining your monetary objectives.

Attending To Fee Framework and Prices

Considering the cost structure and prices is essential when assessing possible investments with your economic expert. Understanding exactly how your expert is compensated helps you make notified decisions concerning where you allot your cash. Start by inquiring about the kinds of fees entailed, whether they're based on a portion of possessions under administration, per hour prices, or flat costs. It's necessary to understand if there are any hidden expenses or service charges beyond the specified charges. Openness in fee disclosure is essential to guaranteeing you aren't captured off guard by unforeseen expenses.

Additionally, inquire about any prospective conflicts of passion that may arise because of the cost structure. As Pension Management , if your expert gets commissions for advising specific products, this could affect their guidance. Make sure you comprehend how these incentives may influence the suggestions you receive. By resolving charge structure and expenses in advance, you can develop a clear understanding of the monetary plan and job in the direction of an equally advantageous partnership with your expert.

Verdict

Finally, by asking necessary inquiries regarding your financial expert's background, accreditations, financial investment strategies, and cost structure, you can make educated decisions and make certain an effective collaboration.

It's critical to align their technique with your goals and make certain openness in your financial plan.

Keep in mind, interaction is type in building a strong relationship with your monetary advisor and accomplishing your monetary objectives.